Last updated 13/04/2021.

Tax registered or not

Whether you are tax registered or not is one of the things that will have been set on the first use page the first time you logged into Groundleader.

If you have indicated that you are tax registered all visits will be charged at the standard tax rate. Tax rates for stock items are set as you create them. Invoices will split item and total costs into ‘pre tax’, ‘tax’ and ‘including tax’ values.

If you have indicated that you are not tax registered tax will not be shown on invoices.

Change your tax status

If at anytime you need to change your tax status select the ‘Other settings’ option from the ‘Global settings’ section of the main menu then ‘Billing & tax rates’ from the next page.

The top section of this page shows your current tax registered status. Here you can change whether you are tax registered or not. Any changes to the your tax status must be made at least one day in advance, this is to prevent any confusion where visits may have already been logged on the current date for the previous status.

If changing to being tax registered be aware that any invoices raised on or after the selected date will include tax costs regardless of when the visits or stock allocation were carried out. The opposite is true If you are changing to being not tax registered. Because of this it is recommended that all uninvoiced visits and stock should be invoiced before changing over.

To change your tax status click the ‘change’ link next to where your current status is shown. You will then be prompted to enter the date on which the change will come into effect.

Cancel a tax status change

If you have a pending tax status change it will be shown underneath your current status. It is possible to cancel any pending change by clicking the ‘cancel change’ link next to it.

Tax rates

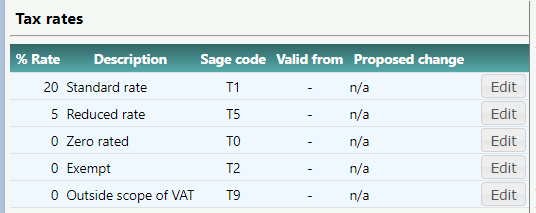

This page can be found by selecting the ‘Other settings’ option from the ‘Global settings’ section of the main menu then ‘Billing & tax rates’ from the next page. The bottom section of this page lists the current tax rates.

VAT is only applied to visits & stock if you have indicated that you are tax registered.

Groundleader makes the 5 main UK VAT rates available to you: Standard, Reduced, Zero, Exempt and ‘Outside the scope of VAT’. If you have indicated that you are not VAT registered all logged visits and allocated stock will be set to the ‘Outside the scope of VAT’ rate. If you are VAT registered all visits will be logged at the standard rate, stock items can be set to any of the rates, for example grass seed would be sold at the reduced rate.

The tax rate table

Editing tax rates

Any changes to tax rates must be made at least one day in advance, this is to prevent any confusion where visits or stock may have already been logged on the current date for the previous rate.

The accounting package ID can also be edited for each VAT rate, See the accounting software integration resources page for more information on this.

To edit a rate click the ‘Change rate’ button next to it in the table. Enter the new rate percentage and the date on which it will come into effect. To cancel any proposed change before it comes into effect click the ‘cancel change’ link next to it.